Pundits frequently credit Donald Trump’s rise, at least in part, to long-standing frustrations some Americans have with an economy that they believe is not working for them.[1] For some, Trump’s brashness is a refreshing departure from a political culture that seems more responsive to the interests of major corporations than to the economic worries of ordinary working people and their families.[2] But the sum of Trump’s economic policies makes it clear that they are a recipe of riches for trickle-down conservatives and billionaires far removed from working families.

As in other issue areas, Trump has offered inconsistent or even outright contradictory economic plans—take the minimum wage, for example[3]—but overall, his vision for the economy shows that his loyalties are not with the American workers who feel they have been left behind. Rather, his loyalties are with the league of trickle-down conservatives who champion the policies that help billionaires such as Trump pull further ahead as middle-class workers struggle to keep up. Just last week, in a speech to the Detroit Economic Club, Trump laid out his clearest vision yet of the economic policy changes he would prioritize as president: tax cuts that favor the wealthy, including a reduction in the top tax rate, the elimination of the estate tax, and a doubling down on other tax treatments that help the wealthiest while removing safeguards that have protected Americans’ consumer, environmental, and other economic interests.[4] Like proponents of trickle-down economics before him, Trump ignores the mounting evidence that the policy has failed to produce income and other economic gains for anyone except the wealthy.[5]

In his speech last week, Trump changed aspects of the tax plan he proposed in September 2015,[6] but he stayed consistent on the theme of helping the wealthy at the expense of middle-class families. An analysis by research firm Moody’s Analytics that looked at Trump’s earlier tax proposals estimated that full enactment of his policies on tax, immigration, and trade—that is, slashing taxes by $9.5 trillion in a way that overwhelmingly benefits the richest Americans, deporting the country’s 11.3 million undocumented immigrants, and significantly altering U.S. trade policy—would start a recession in early 2018 that would last into 2020. There would be as many as 3.5 million fewer jobs by the end of his first term as president.[7]

Still, in his speech on Monday, Trump left out a key piece of his plan for the economy: his proposal to make a so-called deal on the national debt to not fully pay back U.S. creditors—essentially a default.[8] Such a move would cause a sharp increase in interest rates, as lenders would require extra money to compensate them for extra risk.

The Center for American Progress Action Fund estimates that this would have a ripple effect throughout the economy, destroying middle-class wealth and jobs. A default on the national debt could cost a typical homeowner $72,000 in lost home value and kill 3 million jobs.[9] And this default may be one of the very first actions that Trump takes as president, since the United States will need to raise the debt ceiling in March 2017.[10]

At the same time, Trump would increase the chances of a financial crisis and remove economic safeguards for middle-class families by repealing the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2011—the most sweeping financial regulation enacted since the Great Depression.[11] While Trump sometimes has advocated for complete repeal and at other times pledged to release a financial regulation platform that would be, in his words, “close to a dismantling of Dodd-Frank,” the consequences to the U.S. economy could be grave.[12] This would amount to the most rapid financial deregulation in history, as it would eliminate regulations on derivatives, known as weapons of financial mass destruction;[13] abolish stronger capital and liquidity requirements on large banks; dismantle the Consumer Financial Protection Bureau, or CFPB, and more. And a President Trump would find strong support for this deregulation in Congress, as Rep. Jeb Hensarling (R-TX), the chair of the House Financial Services Committee, put out a proposal to dismantle Dodd-Frank this summer.[14]

With characteristic bravado, Trump has asserted and reasserted a vision for the economy that would cause real hardship to millions of American workers and families, all under his banner of “making America great again.” But instead of offering a road map to broadly shared economic prosperity, Trump is championing an economic plan that will dramatically reduce middle-class wealth and limit workers’ access to jobs, even as he proposes massive tax cuts for the wealthiest Americans. It is difficult to understate the drastic consequences of an economy under a President Donald Trump.

Donald Trump’s default

One of the first decisions the next president and Congress will have to make is whether to raise the debt limit in March 2017. More than two-thirds of House Republicans voted against the last budget deal to raise the debt limit in 2015,[15] and even so-called establishment Republicans such as House Speaker Paul Ryan (R-WI) have said that spending cuts are more important than paying the nation’s debt.[16] Senate Majority Leader Mitch McConnell (R-KY) has even said that the debt limit is “a hostage that’s worth ransoming.”[17]

In other words, raising the debt limit with a Republican Congress will require leadership from the next president. That reality should scare every American. After all, Trump has suggested that he could “make a deal” with American creditors to avoid paying them back fully.[18] Moreover, one of Trump’s top allies—Sen. Jeff Sessions (R-AL)—vehemently opposed the 2015 debt ceiling increase.[19]

In fact, Trump’s business record—which he often cites as a benefit of a Trump presidency—shows a pattern of racking up debts and then declining to pay them back in full. He has cheated former employees and contractors, refusing to pay them for work they performed, and contributed to the bankruptcy of a family-owned cabinet making company in Philadelphia after he only paid $83,600 of his $400,000 bill.[20] Trump has paid himself millions of dollars with the proceeds of the Atlantic City casinos he once owned but refused to pay back the bondholders who lent the casinos money.[21] This is a worrisome résumé for a man seeking to lead the country’s largest economy.

The consequence of a Donald Trump “deal” on the federal debt would be a catastrophe. U.S. debt is used throughout the world because it is widely viewed as a risk-free asset, but a default would destroy that.[22] This would cause interest rates to rise, as buyers of U.S. debt would require extra return on their investment—more money—to compensate them for the increased risk.[23] This also would have an immediate negative impact on American families, who would pay more for their credit card balances, mortgage payments, and student loans, since their interest rates are tied to the interest rate on U.S. debt. Furthermore, Trump’s default deal would shortchange Social Security and other programs Americans rely on, since government trusts such as the Social Security trust funds own about 38 percent of federal debt.[24]

The full impact that this could have on the jobs, wages, incomes, and wealth of Americans is impossible to quantify completely. However, below are two brief illustrations of how Donald Trump’s recklessness could affect middle-class families and the economy.

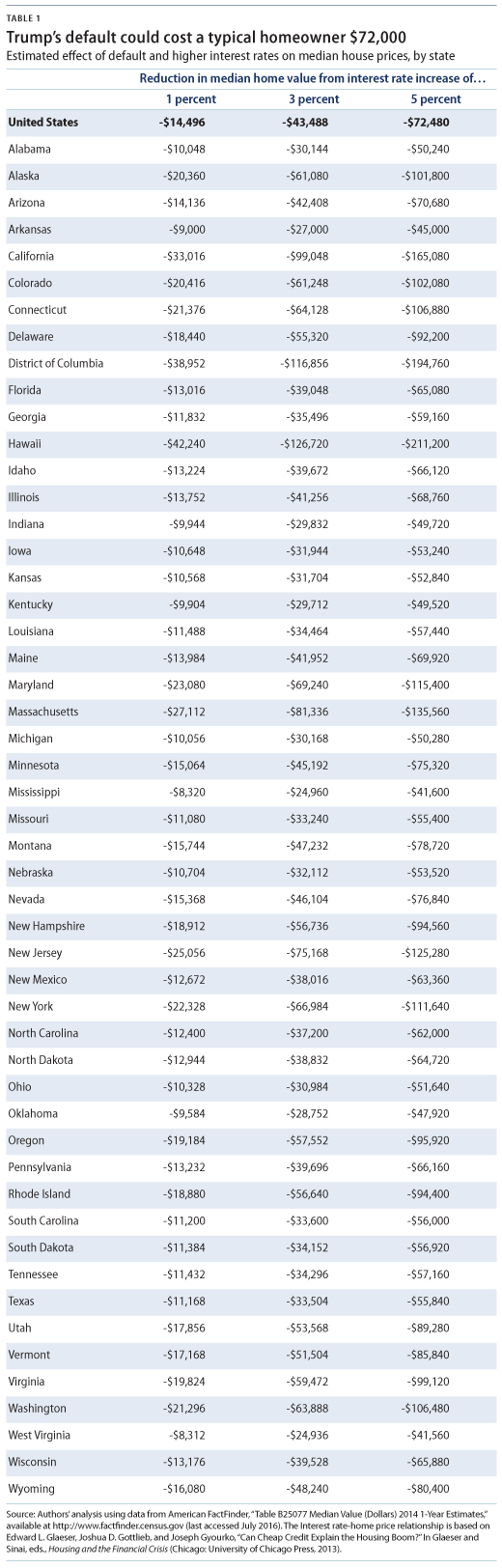

Let’s consider the potential impact of relatively modest increases in interest rates of 1 percent, 3 percent, and 5 percent —interest rate increases that could happen in the case of a credible threat to default or a short default period. It is worth noting that large defaults such as those that occurred in Greece in 2015 and Argentina in 2001—the last two major countries to default on their debt—raised interest rates as high as 50 percent.[25] Moreover, the potential fallout of a future financial crisis could be far more devastating than the Great Recession.

The housing market would destabilize, destroying middle-class wealth in all 50 states

One key impact that Trump’s default would have on the economy is that it would devastate middle-class wealth in the United States by reducing home values.

Higher interest rates resulting from a Trump-manufactured default would make it more expensive for people to buy homes, which in turn would reduce the value of houses because there would be fewer buyers. Those individuals still fortunate enough to be in the position to buy would have lower purchasing power. A recent study by economists at Harvard University and the Wharton School of the University of Pennsylvania estimates that each percentage point rise in the yield on 10-year Treasury rates reduces house prices by 8 percent.[26] This allows us to estimate what the increase in interest rates would do to housing prices.

Failure to raise the debt ceiling and defaulting on the debt, therefore, could end up costing the typical homeowner $72,000 dollars as their house declines 37 percent in value.[27] The dollar amount of the loss in value to homeowners would vary greatly across the country, reflecting the difference in housing prices nationwide. In a relatively expensive state such as Colorado—where the median home is valued at $255,000—the reduction in house prices could be more than $100,000.[28]

And importantly, this decline in house prices would not help middle-class families trying to buy homes; the reason house prices would fall is that the increase in interest rates would make it harder for them to buy a home. A Trump default would destroy trillions of dollars in middle-class wealth while pulling up the ladder on the American Dream of owning a home.

The U.S. economy would lose millions of jobs

Throughout his campaign, Trump has repeatedly emphasized his support of economic policies that would put millions of Americans out of work.

Trump’s default would easily launch the United States into another recession if not a full-blown financial meltdown. Higher mortgage interest rates would devastate the construction and real estate industries.[29] Likewise, higher auto loan interest rates would do the same to the auto industry.[30] Businesses would find it less affordable to borrow to purchase equipment, making them less likely to expand and hire—not to mention that higher interest rates on credit cards would make consumers less inclined to purchase goods and services.

To illustrate the potential effect of higher interest rates on gross domestic product, or GDP, we use an approach used in 2011 by University of Chicago economist Terry Belton and others when they estimated the effect of higher interest rates from a debt ceiling impasse on economic growth. Based on a Federal Reserve study, they estimated that a 1 percentage point rise in interest rates reduces GDP by 0.8 percent.[31] In the chart below, CAP Action estimates the number of jobs lost based on a common rule of thumb in economics known as Okun’s law, which states that a 2 percent reduction in GDP increases the unemployment rate by 1 percentage point.[32]

The resulting job loss is potentially enormous—more than 3 million jobs lost nationwide, as shown in Table 2. Importantly, these estimates do not reflect the effects that a default-fueled financial crisis could have on jobs.

Despite the evidence demonstrating the incredible economic hardship Trump’s rash policies would force on the broader U.S. economy and the workers who would lose their jobs if his policies were enacted fully, he frequently has positioned himself as a pro-worker candidate. Trump has even gone so far as to claim that under his leadership, the Republican Party will become a “worker’s party.”[33] Nonetheless, the data clearly show that his proposal to default on the debt could throw millions of people out of work.

Rapid deregulation

Donald Trump’s economic recklessness does not stop with default. He also would kick off the most rapid financial deregulation in history: the repeal of the Dodd-Frank Act. Dodd-Frank was introduced after the Great Recession to strengthen oversight of the financial services industry in order to curb the risky behavior that engendered the late 2000s financial crisis. As U.S. Treasury Secretary Jack Lew said on the sixth anniversary of the act’s passage:

[W]e can say without question that Wall Street Reform has made our financial system safer and sounder. Banks have added more than $700 billion in additional capital to help strengthen their balance sheets. The vast derivatives market has been pulled out of the shadows, with requirements that standardized derivatives be centrally cleared and traded transparently. … And the Financial Stability Oversight Council has closed regulatory gaps exposed by the crisis, with regulators now working collaboratively and transparently to better identify and respond to potential threats to the financial system.[34]

Another major benefit of Dodd-Frank is the creation of the Consumer Financial Protection Bureau, which is a new federal agency that is intended to “protect consumers from unfair, deceptive, or abusive practices and take action against companies that break the law.”[35] The CFPB’s actions have provided approximately $11.7 billion in financial relief for more than 27 million everyday Americans harmed by unsavory and illegal business practices.[36]

But a central tenet of Trump’s economic plan is his promise to roll back oversight of Wall Street, namely by repealing Dodd-Frank—thus removing the safeguards designed to keep Wall Street in check and prevent the next financial crisis. Trump would undo Dodd-Frank’s limits on the creation of exotic financial products, as well as curtail the robust authority of regulators to step in when banks need to be wound down. Despite Dodd-Frank’s crucial role in preventing the next financial crisis, Trump says he would “absolutely” repeal or largely dismantle it.[37]

And he would find strong support for such a move in Congress: Rep. Hensarling, the chair of the House Financial Services Committee, recently introduced a bill that would gut key provisions of Dodd-Frank such as the Volcker Rule, which bans banks from making big bets, while letting big banks exempt themselves from requirements that they hold a certain amount of safe capital.[38] It would return us to an era of “heads-I-win-tails-you-lose” bets.

Trump, far from being worried about the next economic panic, has said that he “always made a lot of money in bad markets. I love bad markets. You can do very well in a bad market.”[39] Due to the decline in home prices caused by the late 2000s financial crisis, homeowners in the United States lost a collective $9.1 trillion in national home equity between 2005 and 2011.[40] This loss for homeowners was partly due to falling home prices—a market result that Trump, in his own words, welcomed. In 2006, shortly before the financial crisis began, when asked about the possibility of the real estate bubble bursting, Trump responded, “I sort of hope that happens because then people like me would go in and buy.” [41] He further added, “If there is a bubble burst, as they call it, you know you can make a lot of money.”[42]

Trump’s threat to default on U.S. debt payments and his commitment to repealing the laws designed to prevent the next financial crisis demonstrate that his leadership of the American economy would be flat-out destructive to middle-class families, even as it would embolden Wall Street billionaires such as Trump. By defaulting on the debt, Trump would cause a global economic panic, and by rolling back Dodd-Frank, he would re-empower the very same people and interests that drove the U.S. economy into recession during the late 2000s.

Conclusion

Donald Trump’s statements on economic policy, evaluated alongside his business record, offer clear insights into what an economy under his presidency would look like. Although Congress could limit some of the economic proposals of a Trump administration, there is no question that many of the ideas he has articulated while campaigning for the presidency would hit Americans very hard. The economic path Trump has laid out would drain wealth from Americans’ homes, force millions of workers out of work, and empower the very same people who created the last financial crisis, which robbed millions of hardworking people of economic stability. Donald Trump’s economic plans will help billionaires such as him, but middle-class families will be left holding the bag.

Brendan V. Duke is the Associate Director for Economic Policy at the Center for American Progress Action Fund. Ryan Erickson is the Associate Director of Economic Campaigns for the Action Fund. Molly Cain is a Research Associate in the Action Fund War Room.

Endnotes

[1] George Packer, “Head of the Class: How Donald Trump is winning over the white working class,” The New Yorker, May 25, 2016, available at http://www.newyorker.com/magazine/2016/05/16/how-donald-trump-appeals-to-the-white-working-class; Phillip Bump, “Working-class whites see Donald Trump as the champion Mitt Romney never was,” The Fix, May 23, 2016, available at https://www.washingtonpost.com/news/the-fix/wp/2016/05/23/working-class-whites-see-donald-trump-as-the-champion-mitt-romney-never-was/.

[2] Dave Jamieson, “Donald Trump Is Killing It With White, Working-Class Voters In The Rust Belt,” The Huffington Post, January 18, 2016, available at http://www.huffingtonpost.com/entry/donald-trump-working-class-voters_us_56aa44d0e4b0d82286d51ffa.

[3] Michelle Ye Hee Lee, “A guide to all of Donald Trump’s flip-flops on the minimum wage,” Fact Checker, August 3, 2016, available at https://www.washingtonpost.com/news/fact-checker/wp/2016/08/03/a-guide-to-all-of-donald-trumps-flip-flops-on-the-minimum-wage/.

[4] Brendan Duke and Igor Volsky, “Donald Trump’s Billionaires-First Tax Plan,” Center for American Progress Action Fund, August 8, 2016, available at https://www.americanprogressaction.org/issues/economy/news/2016/08/08/153274/donald-trumps-billionaires-first-tax-plan/; Donald J. Trump, “An America First Economic Plan: Winning the Global Competition,” available at https://assets.donaldjtrump.com/An_America_First_Economic_Plan-_Winning_The_Global_Competition_.pdf (last accessed August 2016).

[5] See Michael Ettlinger and Michael Linden, “Middle Class Series: The Failure of Supply-Side Economics,” Center for American Progress, August 1, 2012, available at https://www.americanprogress.org/issues/economy/news/2012/08/01/11998/the-failure-of-supply-side-economics/; Brendan V. Duke, “New Data Illustrate the Failure of the Trickle-Down Experiment,” Center for American Progress, June 29, 2015, available at https://www.americanprogress.org/issues/economy/news/2015/06/29/116130/new-data-illustrate-the-failure-of-the-trickle-down-experiment/; Era Dabla-Norris and others, “Causes and Consequences of Income Inequality : A Global Perspective” (Washington: International Monetary Fund, 2015), available at https://www.imf.org/external/pubs/cat/longres.aspx?sk=42986.0.

[6] Ryan Erickson, “The Best, Smartest, Most Tremendous Giveaway to the Wealthy Few” (Washington: Center for American Progress Action Fund, 2015), available at https://www.americanprogressaction.org/issues/tax-reform/reports/2015/09/28/122254/the-best-smartest-most-tremendous-giveaway-to-the-wealthy-few/.

[7] Mark Zandi and others, “The Macroeconomic Consequences of Mr. Trump’s Economic Policies” (New York: Moody’s Analytics, 2016), available at https://www.economy.com/mark-zandi/documents/2016-06-17-Trumps-Economic-Policies.pdf.

[8] Louis Jacobson, “A closer look at Donald Trump’s comments about refinancing U.S. debt,” PolitiFact, May 16, 2016, available at http://www.politifact.com/truth-o-meter/article/2016/may/16/closer-look-donald-trumps-comments-about-refinanci/.

[9] CAP Action calculations based on Edward L. Glaeser, Joshua D. Gottlieb, and Joseph Gyourko, “Can Cheap Credit Explain the Housing Boom?” In Edward L. Glaeser and Todd Sinai, eds., Housing and the Financial Crisis (Chicago: University of Chicago Press, 2013); American FactFinder, “Table B25077 Median Value (Dollars) 2014 1-Year Estimates,” available at http://www.factfinder.census.gov (last accessed July 2016). See Terry Belton and others, “The Domino Effect of a US Treasury Technical Default” (New York: J.P.Morgan, 2011), available at http://www.thehill.com/images/stories/blogs/on_the_money/morgan.pdf. See David Romer, Advanced Macroeconomics (New York: McGraw-Hill, 2012), p. 193.

[10] Jon Hartley, “Congress Averts Another Standoff By Raising Debt Ceiling In Bipartisan Agreement, Tackling Gridlock,” Forbes, November 2, 2015, available at http://www.forbes.com/sites/jonhartley/2015/11/02/congress-averts-another-standoff-by-raising-debt-ceiling-in-bipartisan-agreement-tackling-gridlock/#67203fb24382.

[11] Sylvan Lane, “Trump: I’d undo ‘very negative force’ of Dodd-Frank,” The Hill, May 17, 2016, available at http://thehill.com/policy/finance/banking-financial-institutions/280245-trump-id-repeal-dodd-frank-not-an-enemy-of-feds.

[12] Ibid.; Heather Long, “Trump’s GOP wants to break up big banks,” CNNMoney, July 19, 2016, available at http://money.cnn.com/2016/07/19/investing/donald-trump-glass-steagall/.

[13] Marion Dakers, “Warren Buffett issues a fresh warning about derivatives ‘timebomb’,” The Telegraph, May 1, 2016, available at http://www.telegraph.co.uk/business/2016/05/01/warren-buffett-issues-a-fresh-warning-about-derivatives-timebomb/.

[14] House Financial Services Committee, “The Financial CHOICE Act,” available at http://financialservices.house.gov/choice/ (last accessed August 2016).

[15] Molly Reynolds, “Who are the House Republicans that sealed the debt deal?”, Brookings FixGov blog, October 30, 2015, available at http://www.brookings.edu/blogs/fixgov/posts/2015/10/30-who-sealed-the-debt-deal-reynolds.

[16] Talking Points Memo, “Paul Ryan: The Wall Street I Know Is Totally OK With Debt Default For A Few Days (VIDEO),” May 17, 2011, available at http://talkingpointsmemo.com/dc/paul-ryan-the-wall-street-i-know-is-totally-ok-with-debt-default-for-a-few-days-video.

[17] Steve Benen, “McConnell looks to end debt-ceiling brinkmanship,” The MaddowBlog, March 9, 2015, available at http://www.msnbc.com/rachel-maddow-show/mcconnell-looks-end-debt-ceiling-brinkmanship.

[18] Jacobson, “A closer look at Donald Trump’s comments about refinancing U.S. debt.”

[19] Pete Kasperowicz, “’We don’t even know the amount’: Sessions slams debt hike,” Washington Examiner, November 3, 2015, available at http://www.washingtonexaminer.com/we-dont-even-know-the-amount-sessions-slams-debt-hike/article/2575273.

[20] Steve Reilly, “USA TODAY exclusive: Hundreds allege Donald Trump doesn’t pay his bills,” USA Today, June 9, 2016, available at http://www.usatoday.com/story/news/politics/elections/2016/06/09/donald-trump-unpaid-bills-republican-president-laswuits/85297274/.

[21] Russ Buettner and Charles Bagli, “How Donald Trump Bankrupted His Atlantic City Casinos, but Still Earned Millions,” The New York Times, June 11, 2016, available at http://www.nytimes.com/2016/06/12/nyregion/donald-trump-atlantic-city.html.

[22] John Kiernan, “Ask the Experts: What Will Happen if the U.S. Defaults?”, WalletHub blog, available at https://wallethub.com/blog/ask-the-experts-what-will-happen-if-the-u-s-defaults/1159/ (last accessed July 2016); Kim Gittleson, “What happens in a US debt default?”, BBC, October 17, 2013, available at http://www.bbc.com/news/business-24453400.

[23] Gittleson, “What happens in a US debt default?”

[24] Heather Long, “Who owns America’s debt?”, CNNMoney, May 10, 2016, available at http://money.cnn.com/2016/05/10/news/economy/us-debt-ownership/.

[25] International Monetary Fund, “Greece: Ex Post Evaluation of Exceptional Access under the 2010 Stand-By Arrangement” (2013), available at https://www.imf.org/external/pubs/ft/scr/2013/cr13156.pdf; International Monetary Fund, “The IMF and Argentina, 1991–2001” (2004), available at http://www.ieo-imf.org/ieo/files/completedevaluations/07292004report.pdf.

[26] Glaeser, Gottlieb, and Gyourko, “Can Cheap Credit Explain the Housing Boom?”

[27] CAP Action calculations based on ibid.; American FactFinder, “Table B25077 Median Value (Dollars) 2014 1-Year Estimates.”

[28] Ibid.

[29] Chris Arnold, “Will A Fed Interest Rate Hike Slow The Housing Recovery?”, NPR, December 15, 2015, available at http://www.npr.org/2015/12/15/459690556/battered-home-builders-remain-wary-of-interest-rate-increases.

[30] Federal Reserve Bank of San Francisco, “How does monetary policy affect the U.S. economy?”, available at http://www.frbsf.org/education/teacher-resources/us-monetary-policy-introduction/real-interest-rates-economy/ (last accessed July 2016).

[31] See Belton and others, “The Domino Effect of a US Treasury Technical Default.”

[32] See Romer, Advanced Macroeconomics, p. 193.

[33] Joshua Green, “A day in the life of Reince Priebus, reluctant GOP peacemaker,” Bloomberg Businessweek, May 26, 2016, available at http://www.bloomberg.com/features/2016-reince-priebus/.

[34] U.S. Department of the Treasury, “Statement From Secretary Lew on the Six-Year Anniversary of the Enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act,” Press release, July 21, 2016, available at https://www.treasury.gov/press-center/press-releases/Pages/jl0525.aspx.

[35] Consumer Financial Protection Bureau, “About Us: The Bureau,” available at http://www.consumerfinance.gov/about-us/the-bureau/ (last accessed July 2016).

[36] Zixta Q. Martinez, “Consumers Count: Five years standing up for you,” Consumer Financial Protection Bureau Blog, July 14, 2016, available at http://www.consumerfinance.gov/about-us/blog/consumers-count-five-years-standing-you/.

[37] Kevin Cirilli and Bob Cusack, “Trump: Economic bubble about to burst,” The Hill, October 14, 2015, available at http://thehill.com/homenews/campaign/256851-trump-economic-bubble-about-to-burst; Lane, “Trump: I’d undo ‘very negative force’ of Dodd-Frank.”

[38] Finkle, “Republicans Unveil Plan to Revamp Dodd-Frank.”

[39] Manu Raju, “In 2004 interview, Trump hails ‘bad markets’,” CNN, May 26, 2016, available at http://www.cnn.com/2016/05/26/politics/donald-trump-bad-markets-2004/.

[40] Governmental Accountability Office, “Financial Crisis Losses and Potential Impacts of the Dodd-Frank Act.”

[41] Jeremy Diamond, “Donald Trump in 2006: I ‘sort of hope’ real estate market tanks,” CNN, May 19, 2016, available at http://www.cnn.com/2016/05/19/politics/donald-trump-2006-hopes-real-estate-market-crashes/.

[42] Ibid.